Furniture Madness!

Homeownership Set-aside

Program (HSP)

First-time homebuyers are provided down payment, closing cost and repair assistance if earnings are at or below 80% of the Area Median Income (AMI) for households purchasing or constructing homes in Colorado, Kansas, Nebraska and Oklahoma.

Single Family Housing

Guaranteed Loan Program

This program assists approved lenders in providing low and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas.

NIFA Homebuyer

Assistance Program

Open the door to homeownership, even if you do not have enough money saved for down payment and closing costs. Our HBA Program can help you buy a home with a minimum investment of $1,000.

Helping you find your dream home.

How it works.

Take a few minutes to fill out our secure online application. Through straightforward questions, we’ll accurately capture your unique financial situation and take the guesswork out of your house price point. Once submitted, you will be contacted by one of our personal lenders who will walk you through your options and next steps.

Who can pre-qualify?

Anyone! Pre-qualifying is simply the first step in the process of buying a house. It’s where you provide a snapshot of your financial situation and receive an ideal price point and mortgage payment for your home.

Why Exchange Bank?

Our lenders love nothing more than helping you find the perfect home that doesn’t break your bank account. To ensure unparalleled service, you work with the same lender from start to finish. Meet with them, call them up, whatever you need to put you at ease through the homebuying process.

Get a head start on your mortgage today!

When you’re buying a home, you’ve got a lot on your mind – you might be anxious, overwhelmed, excited … maybe a little of everything?

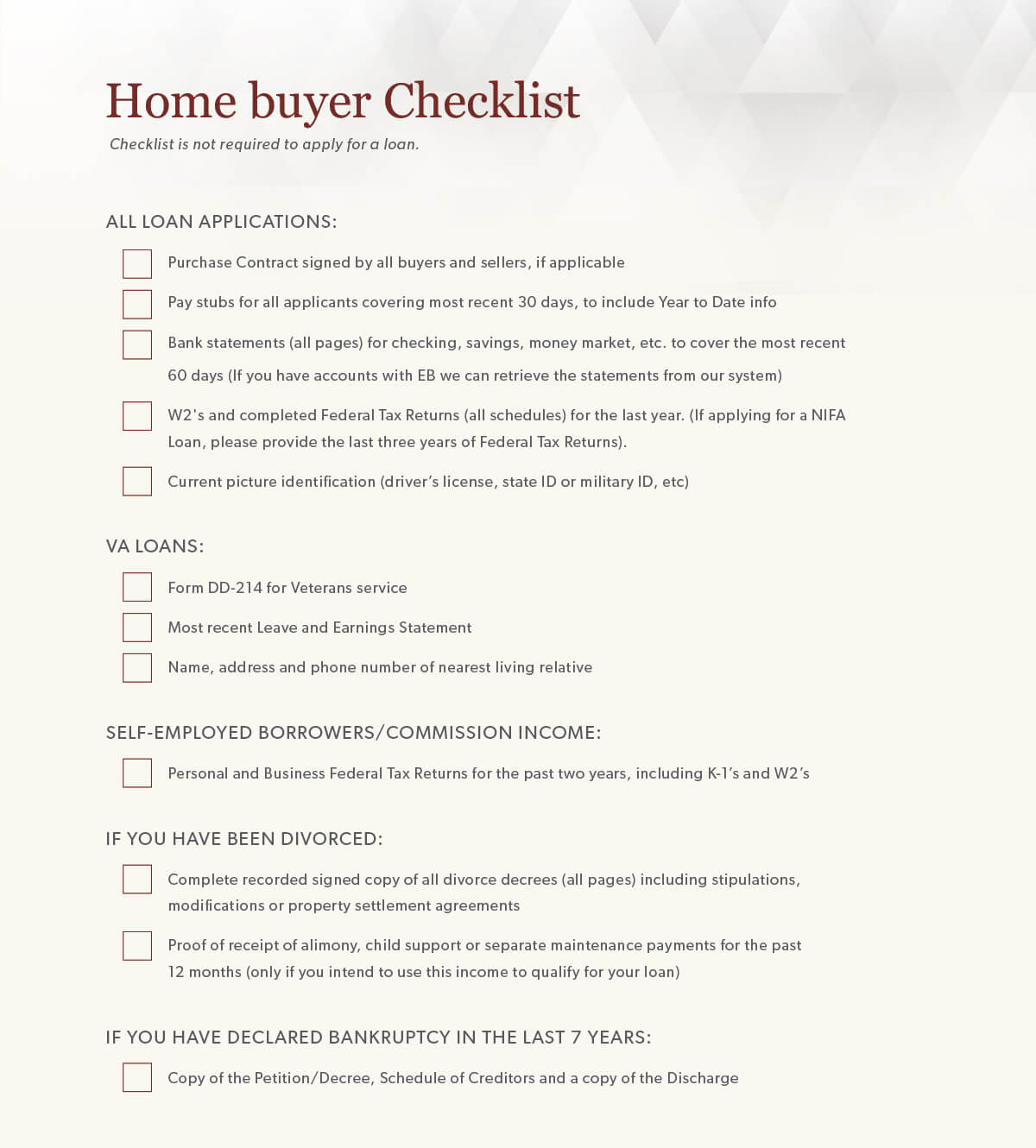

At Exchange Bank, we’re busy dreaming up ways to make purchasing a home simple and streamlined. So we’ve put together a comprehensive Homebuyer’s Checklist with everything you need to get started!

- Must be approved for an Exchange Bank Pre-Qualification during the months of March-May 2023.

- Must close on loan by October 31, 2023.

- Home loan must be with a mortgage lender from Exchange Bank Kearney or Gibbon Branches.

- Must own residence for refinancing.

- Must be owner occupied residence – no investment properties.

- Exchange Bank’s Furniture promotion is done in partnership with Slumberland Furniture and the value of this bonus will be reported to the IRS. The recipient is responsible for any federal, state or local taxes on this offer. Exchange Bank reserves the right to limit each customer to one new account-related gift incentive per calendar year.

- The $1,000 Gift Card/Store Credit can only be used in Slumberland Furniture’s Kearney, Grand Island and Columbus locations.

- Buyers’ name and phone number will be provided to Slumberland Furniture for the purpose of applying the $1,000 store credit. At loan closing a $1,000 gift card will be given to buyers. Gift card is not necessary to make purchases at Slumberland Furniture.

- Participation in Exchange Bank’s Furniture Promotion disqualifies applicants from the Exchange Bank $150.00 cash bonus incentive.

- Some restrictions apply. See an Exchange Bank Home Mortgage Loan Officer for complete details.

- Offer subject to credit approval.

- This promotional is limited to EB traditional home loans and excludes in-house balloon/portfolio loans.

- Offer valid while quantities last.

Restrictions apply. See a Exchange Bank Home Mortgage Loan Officer for complete details.